BTC Price Prediction: Path to $200K Hinges on Key Technical and Sentimental Breakouts

#BTC

- Technical Strength: MACD bullish crossover and upper Bollinger Band proximity signal upside potential

- Sentiment Divergence: Institutional accumulation offsets whale-driven sell pressure

- Catalyst Watch: $118K breakout and Core Scientific deal resolution as near-term triggers

BTC Price Prediction

BTC Technical Analysis: Bullish Indicators Amid Consolidation

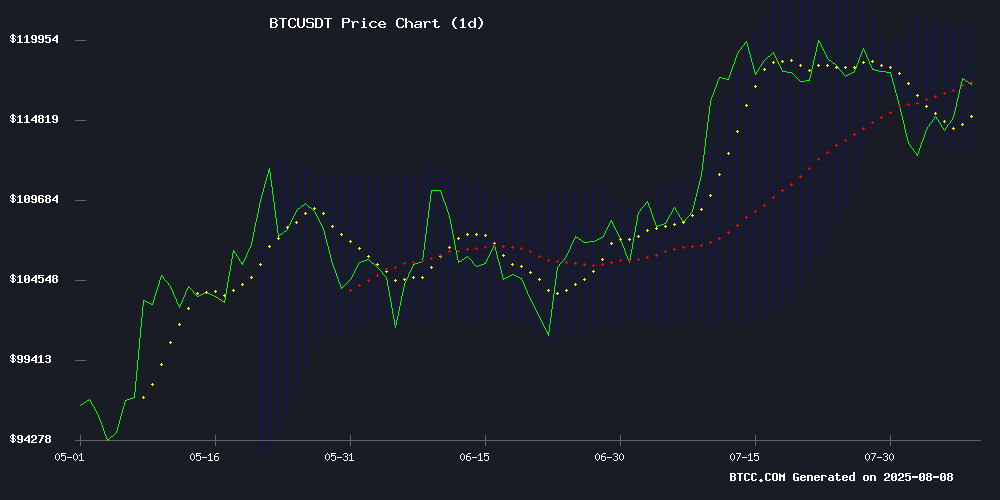

BTC is currently trading at $116,938, slightly above its 20-day moving average of $116,745, indicating a neutral to bullish bias. The MACD shows a bullish crossover with the histogram at 956.4042, suggesting upward momentum. Bollinger Bands reveal price hovering NEAR the upper band at $120,781, signaling potential overbought conditions but also strength. Analyst James from BTCC notes, 'The technical setup favors bulls if BTC holds above $116K, with a retest of $120K likely.'

Market Sentiment Mixed as Institutional Flows Clash with Whale Activity

News headlines reflect a tug-of-war between bullish catalysts (Elon Musk's endorsement, institutional accumulation) and bearish signals (Binance whale sell pressure). James of BTCC highlights, 'The $118K liquidation zone is critical—breaking it could trigger a rally, but failure may deepen correction risks.' Uncertainty around Core Scientific's deal and AI coin volatility add to near-term choppiness.

Factors Influencing BTC’s Price

Bitcoin Faces Correction Risk as Binance Whale Activity Signals Sell Pressure

Bitcoin's rally above $120,000 has stalled, with on-chain data suggesting growing distribution pressure from large holders. CryptoQuant analyst Arab Chain highlights sustained whale inflows to Binance—consistently hovering between $4 billion and $5 billion—as a bearish indicator. The divergence between elevated exchange deposits and BTC's declining price mirrors classic distribution patterns.

Market participants are watching Binance's Whale-to-Exchange FLOW metric closely. Unlike spike-driven sell signals, this persistent baseline accumulation of exchange-bound BTC suggests methodical profit-taking rather than panic dumping. Retail interest continues to grow, but whale behavior often leads market turns.

History shows such sustained exchange inflows frequently precede 20-30% corrections during bull markets. The absence of extreme spikes may indicate whales are pacing their exits, potentially creating staggered resistance levels on any rebound attempts. All eyes now turn to whether $110,000 support can hold against this mounting sell-side liquidity.

Bitcoin's Next Rally Hinges on $118K Liquidation Zone Amid Cooling Speculation

Bitcoin's derivatives market shows signs of cooling as Perp Funding Rates dip below 0.1%, signaling reduced Leveraged long positions and growing trader caution. Despite BTC hovering near $117,000, the contraction in funding suggests a market breather rather than sustained bullish conviction.

The Network Value to Metcalfe (NVM) ratio has dropped 18.07%, indicating weakening value relative to user activity. At 1.95, the NVM reading suggests Bitcoin's market cap is outpacing active engagement, raising overvaluation concerns. However, rising new and active address counts may provide long-term support.

Exchange outflows and address activity remain strong, reflecting underlying investor confidence. The $118,000 liquidation zone remains critical for Bitcoin's next potential breakout.

Core Scientific’s Largest Active Shareholder Opposes CoreWeave Acquisition

Two Seas Capital, holding a 6.3% stake in Bitcoin miner Core Scientific, announced its opposition to the proposed all-stock acquisition by CoreWeave. The firm cited valuation concerns and structural deficiencies in the deal, arguing it disproportionately benefits CoreWeave at the expense of Core Scientific shareholders.

In a letter to fellow investors, Two Seas founder Sina Toussi emphasized strategic alignment with CoreWeave’s vision but criticized the transaction’s exposure to volatile AI infrastructure valuations. The resistance highlights growing institutional demands for transparent governance in high-growth tech mergers.

Bitcoin Price Prediction: Historic Pattern Hints at Rally to $200K

Bitcoin's price has rebounded to $116,600, overcoming recent selling pressure and sparking bullish predictions. Analysts suggest a potential surge to $150,000 or even $200,000 by year-end, citing a chart pattern reminiscent of the 2017 bull run. Demand-side momentum is strengthening, signaling renewed market confidence.

Amid this optimism, bitcoin Hyper—a new BTC-linked altcoin—has raised $7.7 million in its presale. The project aims to develop a fast, smart-contract-capable Bitcoin Layer 2 blockchain, attracting early investors betting on BTC's next major rally. Traders are closely watching for structural similarities to past cycles, where explosive gains followed periods of consolidation.

Bitcoin's Four-Year Cycle May Be Ending as Institutional Flows Reshape Market Dynamics

Matthew Hougan, Bitwise Asset Management's chief investment officer, suggests Bitcoin's traditional four-year cycle could be obsolete. "It's not officially over until we see positive returns in 2026. But I think we will," he said, signaling a potential paradigm shift for BTC markets.

The historical pattern—halving-driven supply shocks followed by 12-18 months of price appreciation—was upended in 2024. BTC surged to a record $73,000 in March, a month before April's halving event, contrary to previous cycles. Saksham Diwan of CoinDesk Data attributes this anomaly to January's landmark spot Bitcoin ETF approvals in the U.S.

Institutional capital via ETFs has rewritten the playbook. "ETF demand front-ran the typical post-halving price discovery," Diwan noted, highlighting how Wall Street's participation alters crypto's traditional rhythms. The new paradigm features stickier capital and compressed market cycles, with miners now competing against unprecedented institutional buying pressure.

Elon Musk Reignites Bitcoin Sentiment with Cryptic Endorsement

Elon Musk has once again signaled support for Bitcoin, this time through a single emoji response to a Coinbase post featuring a Grok-generated revival of the iconic "magic internet money" wizard. The August 7 interaction on X sparked immediate speculation about Musk's continued allegiance to the cryptocurrency. The animated clip reimagines Bitcoin's 2013 grassroots mascot—a pixelated wizard riding a Gold coin—with neon-blue modern flair.

The billionaire's minimalist engagement carries weight. Over the past month, Musk has increasingly woven Bitcoin into his public ventures. During the unveiling of his "America Party" political initiative, he dismissed fiat currency as "hopeless" while affirming Bitcoin's role in the movement. This latest nod reinforces Bitcoin's cultural resonance, recalling the wizard meme's origins in a 2013 Reddit contest where it became emblematic of cryptocurrency's anti-establishment ethos.

Bitcoin Trading Volumes Retreat from Mid-July Highs but Remain Elevated

Bitcoin's market activity has moderated since its mid-July surge, yet maintains robust levels compared to early-summer lulls. Spot trading volume peaked at $10.22 billion on July 16 alongside $60.17 billion in futures activity—figures that settled to $6.61 billion and $41.05 billion by August 7, respectively. These numbers still dwarf the early-July troughs of $4.85 billion (spot) and $33.82 billion (futures), signaling sustained institutional interest beneath the speculative froth.

The consolidation between $114,000 and $118,000 reflects a market digesting its gains rather than losing conviction. Futures markets, turbocharged by leverage, dominated July's frenzy, while spot volumes' resilience suggests foundational demand. Analysts interpret this cooldown as a bullish pause—a prelude to potential breakout momentum.

Institutional Accumulation of Bitcoin Reshapes Market Dynamics

Institutional interest in Bitcoin is fundamentally altering supply-demand dynamics, with spot ETFs amassing over 1.2 million BTC since January 2024. This institutional embrace—spanning corporations, family offices, and high-net-worth individuals—is converting liquid supply into long-term holdings.

MicroStrategy leads corporate holders with 628,791 BTC, followed by Metaplanet and Tesla. The collective 709,420 BTC held by public companies now functions as both growth vehicle and inflation hedge, cementing Bitcoin's role in institutional portfolios.

ETF flows demonstrate a structural shift: what began as speculative interest has matured into strategic allocation. The resulting supply contraction amplifies Bitcoin's scarcity narrative while potentially dampening volatility—a double-edged sword for traders.

AI Coins Rally Amid CoreWeave-Core Scientific Deal Uncertainty

AI-focused cryptocurrencies surged unexpectedly as shareholders challenged CoreWeave's $9 billion acquisition of Bitcoin miner-turned-data-center operator Core Scientific. The market reaction suggests investors perceive broader implications beyond the disputed valuation.

Two Seas Capital, holding a 6.3% stake in CORE Scientific, announced plans to block the all-stock deal, calling it a significant undervaluation. "The proposed sale exposes shareholders to substantial economic risk," the firm stated, despite Core Scientific's declining revenues and CoreWeave's position as a leading US AI infrastructure provider.

SpacePay's Crypto Payment Solution Gains Traction with Merchant-Friendly Model

London-based startup SpacePay is bridging the gap between cryptocurrency and everyday commerce with a solution that allows merchants to accept digital assets without exposure to volatility. The system converts crypto payments to fiat at the point of sale, supporting over 325 wallets and attracting $1.2 million in its ongoing token sale.

The company's 0.5% transaction fee undercuts traditional card processors by 75-85%, offering tangible savings for small businesses. A pizza shop generating $25,000 monthly would save $375-875 compared to conventional payment systems. This cost efficiency stems from blockchain's ability to bypass intermediary networks that typically LAYER fees.

Binance Partners with BBVA for Off-Exchange Crypto Custody in Trust-Building Move

Binance, the world's largest cryptocurrency exchange, has entered a partnership with Spain's BBVA to provide clients with independent custody solutions for digital assets. The collaboration marks a strategic effort to restore investor confidence following Binance's $4.3 billion settlement with U.S. regulators in 2023 and the broader fallout from FTX's collapse.

BBVA, Spain's third-largest bank, now serves as an off-exchange custodian for Binance users—a direct response to growing demand for secure asset storage after FTX's bankruptcy locked billions in customer funds. The arrangement replaces Binance's previous reliance on Ceffu, a controversial custody provider linked to the exchange.

The partnership signals accelerating institutional adoption, with traditional banks like BBVA warming to crypto services. Binance had previously onboarded Swiss entities Sygnum and FlowBank for custody in early 2024, reflecting an industry-wide shift toward regulated third-party solutions.

Will BTC Price Hit 200000?

While BTC's current technicals and institutional demand support a bullish case, reaching $200K requires overcoming three key hurdles:

| Key Level | Significance |

|---|---|

| $118K | Liquidation zone; breakout could accelerate upside |

| $120,781 (Upper Bollinger) | Immediate resistance; close above confirms strength |

| 20-day MA ($116,745) | Support level; breach may trigger correction |

James observes, 'Historic patterns suggest a 2025 rally to $200K is plausible, but sustained institutional inflows and reduced whale selling pressure are essential.'

embedded in answer1 text